How To Generate A Consistent Flow of Mortgage Leads Using Facebook Ads

Introducing The Facebook Lead Ad

Seven Secrets To Success

Watch a video or audio of this post:

Prefer to listen to the audio file?

Click to listen or download the file.

Who this post is for?

That want to learn how to fill their sales funnel using Facebook Ads. You will DISCOVER that successful lead campaigns are not only possible but can be used on an ongoing basis to generate a steady flow of mortgage customers.

In this post, I will share six secrets that set you up in the right direction with winning campaigns that generate ongoing mortgage leads.

Our goal with Facebook Ads is to reach the ideal target customer with an ad at the right time – when a prospect needs your mortgage products, and then increase the likelihood of conversion for you, the mortgage advertiser, once the prospect sees the ad.

Our targeting is achieved via Facebook's ad platform – one of the most amazing and robust ad platforms ever offered to advertisers.

Campaign Results #1

Case Study Results: 5 to 10 Leads Delivered Daily

Campaign overview: this lead generation campaign was run in northern California targeting first-time home buyers and first responders. Ad budget was $100 - $150 per day.

Leads are the top purple line, lower line is cost per lead.

Facebook mortgage leads trending line chart over cost per lead

Facebook mortgage leads trending line chart over cost per lead

Campaign Results #2

Case Study Results: 5 to 8 Leads Delivered Daily

Campaign Overview: This campaign is running in the tri-state area of New York, New Jersey, and Connecticut. The campaign is targeting new construction, ground-up developments, and home renovations.

Facebook Leads for Home Construction Loan

Facebook Leads for Home Construction Loan

And regardless of the changes by big tech companies to limit consumer tracking, for example, consumers using Apple's iOS or with Google products, Facebook's ad platform has not lost a step. Facebook still cranks out mortgage leads when you have the correct pieces in place.

To increase the likelihood of conversion, however, we need to reduce friction (built-in skepticism, reluctance to listen to your message and offer) during the ad process.

How is this achieved?

- First, effective creative (messaging/copy and imagery) so that you build rapport quickly and lower resistance to your messaging.

- Second, through targeting the right people and cutting out the waste of showing your ad to people who are not interested

In this post, I will use case study examples and go over the most critical factors of a successful Lead Ad campaign so that you can profitably generate mortgage leads on an ongoing basis to fill your sales funnel with eager customers, and feel confident you are saving time and doing it right.

Stay with me here...

What Are Facebook Lead Ads?

Simply put, Facebook Lead Ads are part of the Lead Generation campaign objective that allows you to capture leads right within the Facebook interface efficiently – easy for you, easy for the customer.

The Lead Generation objective is one of 11 different campaign objectives that Facebook offers advertisers. Each of these campaign objectives aligns to a different business outcome, whether that's brand awareness, traffic to your website, video views, or actual leads, as we're focused on here.

You Can Spend As Little As $1 per Day

Facebook's ad platform gives you complete control of how much you spend. You can spend as little as a dollar a day to thousands a day in ad spend. Either way, you have an amazing opportunity to succeed regardless of your budget.

And considering that your potential prospect's eyeballs are focused on Facebook and Instagram (Facebook owns Instagram) daily, you would be wise to embrace this advertising channel in some form.

Consider that the amount of time people spend on the next five most popular social apps does not sum to the amount of time people spend on Facebook, let alone adding in time spent on Instagram. So be where the eyeballs are.

Facebook Is Pay To Play

But keep in mind, without ad spend, you have no leverage on the platform. Organic non-paid posts have almost no reach or exposure whatsoever. But with ads your reach and exposure on the Facebook and Instagram is unlimited. And the larger your ad budget, the bigger your results.

As a side note, if you have ever done a Boost Post or are considering it, here's why the Boost Post ad is NOT an effective campaign objective to ever use if your goal is leads.

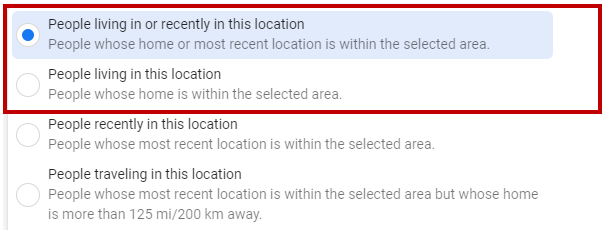

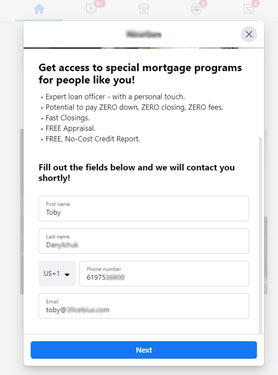

Example Lead Ad

This ad is targeting Millennial Renters as first-time buyers. Once someone clicks on the Learn More button, the form fill opens up. Facebook will pre-fill this form with the prospects information which makes this process uber simple and seamless.

Facebook ad first-time buyer millennials

facebook lead ad with form -mortgage, millennials

Facebook lead ad with form fields

The image and the content of the form can all be edited to align with your customer avatar. You can also ask pre-qualifying questions if needed to screen out people that may not be a good fit for your particular loan program. Once someone submits their information, it can be sent to you via email, stored in a secure doc, or integrated directly into your CRM.

50 Mortgage Broker Facebook Ads

Hits and Misses

Get your creative ideas flowing now. Download our PDF ebook.

Benefits of Lead Ads:

6 Critical Success Factors To Successful Mortgage Lead Ad Campaigns on Facebook

1

Decide Which Customers Do You Want To Target

First-time millennial home buyers? Cash-Out Refi? First responders? FHA? Jumbo Loans? Non-QM. All of these are possible and more.

You have the ability here to focus on specific customer types within Facebook. Do you want to push re-fi, target first-time millennial homebuyers, do you have a special program for first responders?

Identify who you want to target.

Your choice here will determine the following:

Why is this important?

Your ads will have higher conversion rates and lower costs if you write ads that align to each customer segment.

Writing generic ads and trying to be all things to all people lowers the conversion rate with your ads. Lower response rates will cost you more money, and your ad will not perform as well.

How you speak to a millennial first-time buyer is different than someone financing a jumbo loan, or a cash-out Re-Fi, or a VA customer, for example. Each customer persona has different wants and needs.

Customer Persona Targeting Examples:

First-Time Millennial Home Buyers

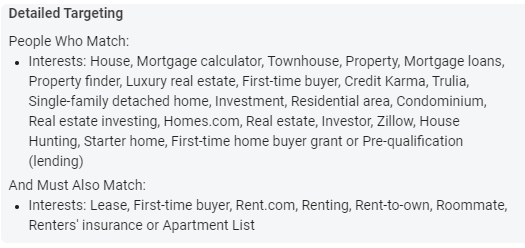

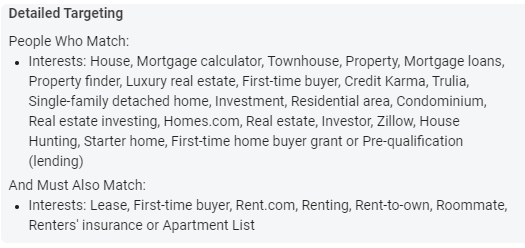

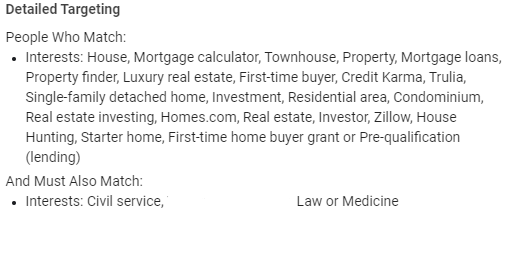

To build our audience, we have detailed targeting such as Mortgage Calculator, First-time Home Buyer Grant, Pre-qualification Lending, etc, which gets us close, but then we narrow this down further using, "And Also Must Match," and choose additional targeting criteria that narrows the targeting. We cannot age discriminate by selecting the age ranges for millennials, so we have to be more creative in how reach them with Facebook's Detailed targeting. In addition, your ad copy and imagery will help down select for Millennials, too.

Facebook targeting for first-time millennial home buyers

Facebook targeting for first-time millennial home buyers

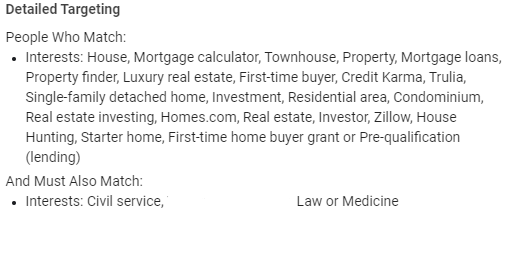

First Responders Targeting

Now for First Responder targeting, you will have to rely more on your ad imagery and ad copy to segment out those people in that industry. Facebook's detailed targeting is limited so it's more challenging to segment specifically for that niche. This does not mean you cannot reach First Responders - you can, but your ad copy and imagery will help down select for these customers.

Facebook ad targeting to reach first responders

Facebook ad targeting to reach first responders

You can specifically target each of these personas and others too within Facebook and Instagram.

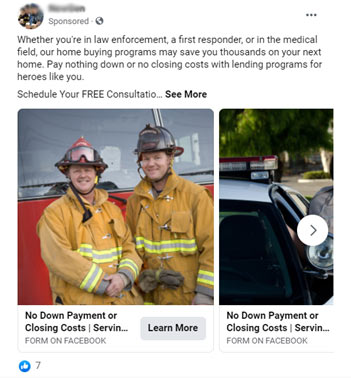

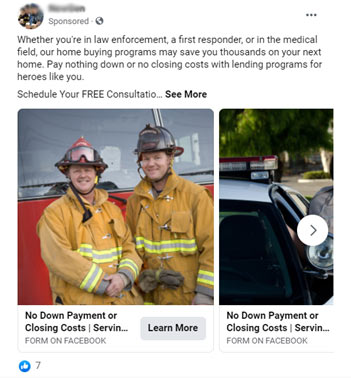

Here is an example of First Responders Facebook ad creative - in this case it is a Carousel Ad which allows the Facebook user to scroll through different images within the ad. Writing your ad with your ideal customer avatar in mind will resonate them far better than a generic ad targeting everyone.

Facebook Lead Ad first Responders

Facebook Lead Ad first Responders

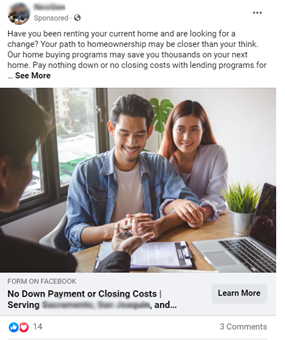

Compare those two ads to the home loan video ad below – it's more generic messaging, not specific to a particular customer like first-time millennial buyers or the first responders.

Facebook video ad for mortgage loan

Facebook video ad for mortgage loan

The bottom line is that the more you speak precisely to a customer's needs and wants, the more success you will have. The above ad might be ok for general branding and awareness but not optimal for a Lead Generation ad.

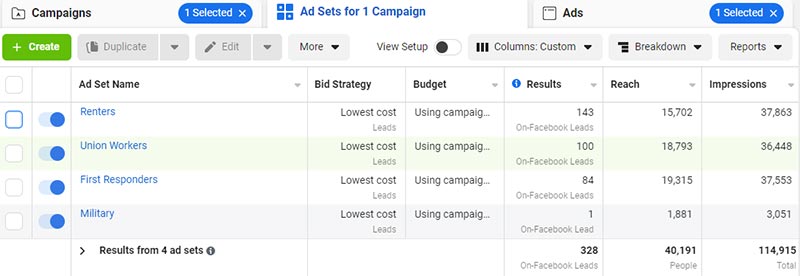

Below is an image showing the ad sets setup by customer persona (Renters, Union Workers, First Responders, Military) - to the right you can see how many leads, Reach, and Impressions.

Facebook Mortgage Ad Sets Customer Segments

Toby Danylchuk, Founder, 39 Celsius

A Word About Compliance and the Fair Housing Act

To adhere to fair housing guidelines, Facebook has implemented the following measures which automatically takes care of most of any issues you will run into in regard to compliance:

Discover How Our Agency Can Drive More Leads and Sales To You

SEO - increase traffic and leads from Google

Content Marketing - from a data-driven topic strategy to awesome content

Paid Ads - Google Ads and Paid Social Media

Facebook Mortgage Ad Sets Customer Segments

2

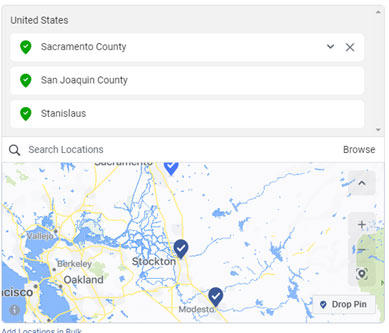

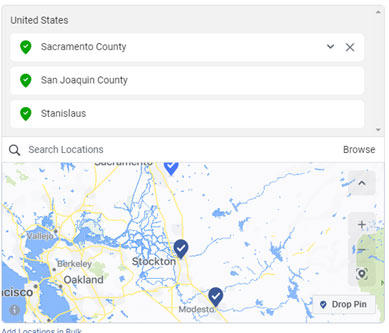

What Geographic Area Are You Targeting?

Facebook provides many different ways to target potential prospects geographically

You want to cast a wide net geographically that will encompass the largest audience possible. So that might mean targeting a couple of counties or a 50 - 60 mile radius depending on the population density.

A good barometer to use is that if you can serve someone in the area you're targeting, and they would likely want to use you even though you might be a bit of a drive, then target that area to start with.

You can continually refine your targeting later, too, if you find it's too wide geographically and you're getting leads that are too far away.

What is important is that you make your initial audience as large as possible. Facebook's algorithm works better at delivering ideal results with a larger data set.

Here's an example of targeting three counties in northern California. You can also do radius targeting (e.g., 20-mile radius from your office) or you can type in zip codes, city names, among other geographic targeting options.

Facebook Geographic Targeting

Facebook Geographic Targeting

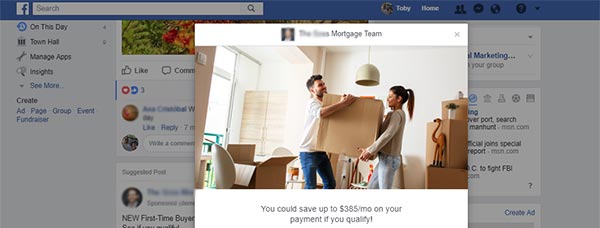

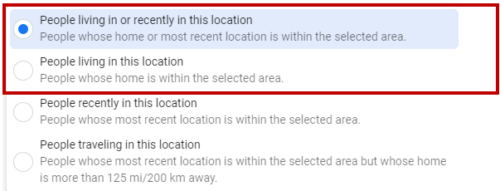

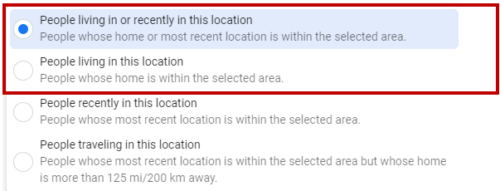

One of the additional options for geotargeting is down-selecting to one of the below options.

Use one of the two first options –

facebook ad geotargeting additional options

facebook ad geotargeting additional options

You can toggle between these two options and see the audience size change within the Facebook ad interface while you're building the ad and before it is published live.

Using the option, People living in our recently in this location, allows you also to target people who are home shopping in areas that they don't currently live in versus just people living in that specific area, which is the second option.

3

What Is Your Psychographic Targeting (Detailed Targeting)?

Interests, Behaviors, Demographics

Here's where you see the real power of Facebook targeting – Interests, Behaviors, and Demographics. Facebook has unrivaled consumer behavior signals you, as an advertiser, can utilize.

Because you're advertising mortgage-related products, you are subject to the guidelines of the Fair Housing Act and Facebook's policies to prevent advertisers from discrimination.

Mortgage and real estate ad campaigns are labeled a Special Ad Category by Facebook so some targeting options are not available that otherwise are for a different niche.

But fret not…

LOTS of leads are still there for the taking to fill your sales funnel to the brim.

In this example, I'll use first-time home buyers.

Potential interests and behaviors:

Keep in mind; this is just a sample of some of the interest options you can use for first-time home buyers. You would also modify these targets, of course, if you were targeting VA, or Re-Fi, etc. But for this example, we're looking for people that have an interest in:

There are many more targets than the shortlist above.

How great are those Interest targets?

These are unambiguous clear signals that allow you to get in front of the right person that needs your services.

Now let us focus this even more...

If your customer avatar is renters looking to buy their first home, you would also consider layering on the following interests as an - AND - operator – meaning they must meet both the above criteria AND the below, allowing us to down-select for potential first-time buyers:

Now you have narrowed your targeting on the customer persona of first-time buyers.

No other platform provides that level of targeting with so much flexibility and control over all aspects of your advertising campaigns.

You can use a similar approach to target any number of different customer avatars that you want – Teachers, First Responders, Cash Out Re-Fi loans, FHA, Jumbo loans, and more.

4

Retargeting - Prospects That Did Not Submit Form

Interacted with your ad but never submitted their information

One of the more compelling reasons why using Facebook ads to sell mortgage products and services is so effective is that you can retarget people that interacted with your ad (i.e. clicked on it), but never submitted the form to you. For whatever reason, these people either got cold feet or were distracted and were just not ready to submit their information.

This is normal consumer behavior.

But Facebook has a solution for us advertisers.

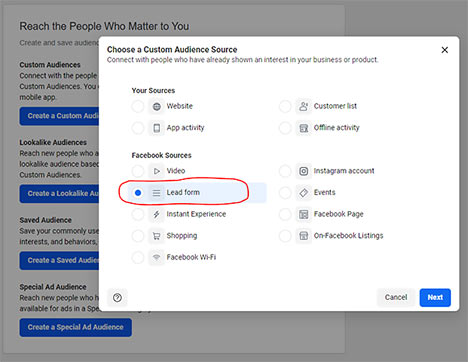

We can create what is called a Custom Audience from those people that interacted with the ad but did not submit it. You would choose Lead Form, then click Next.

Facebook Custom Audience From Lead Ad

Facebook Custom Audience From Lead Ad

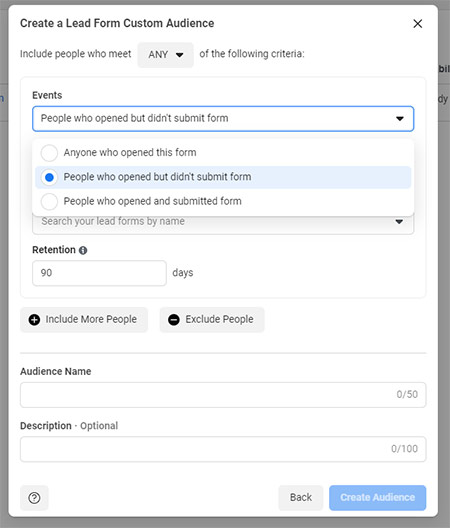

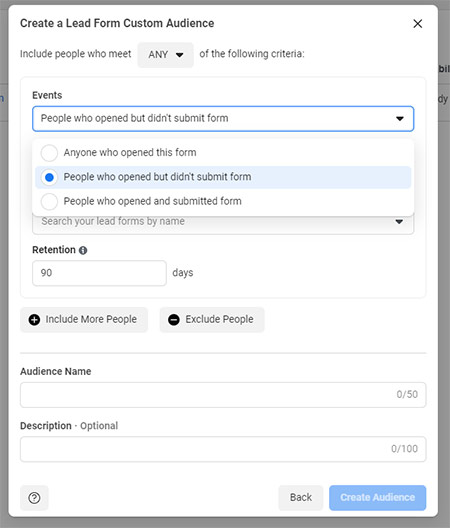

And then choose the 2nd radio button option in the drop down. Leave retention to 90 days (the max that it can be set to). Give it a recognizable name and click on Create Audience.

Facebook Lead Ad Retargeting

Facebook Lead Ad Retargeting

Once you have created your Custom Audience, you can use it now in an ad with copy and creative specific to those specific people. Instead of targeting that we used under Interests, Behaviors, and Demographics, we will use this saved Audience as our targeting - there's no need to down select for anything else.

5

Facebook Ad Budgets - How Much?

Volume of your leads is partly determined by your ad spend.

Budgets are critical to success and will directly impact how many mortgage leads you get. Therefore, the larger your budget the more leads you will acquire.

What's the correct monthly budget?

How much should I spend on Facebook ads?

The answer to that question depends on many variables such as your goals, what marketing budget you have, audience size, competition, and more,

BUT…

Here's a process you can use to determine the proper Facebook ad budget. Start here and adjust as you see the campaign results. (a related post here, how should you spend on google ads).

Since we are focused on lead generation, start with an estimate of the cost per lead and back into the spend you need to reach your goals.

For example, If the cost per lead is $10 and you wanted on average 50 leads, then you would start with $500 per month in ad spend.

For mortgage leads, the cost varies from $10 to $40 per lead on average. Your mileage will vary, of course, and not everyone that signs up is ready for a mortgage at that immediate time. So perhaps start with a reasonable $15 per lead cost – just as a starting point and adjust as you see the data.

So, if you wanted to generate 33 leads, you would need to spend approximately $500.

But the bare minimum ad spend you could set for one month with Lead Generation as the campaign objective is $300. You can set lower budgets, of course, with different campaign objectives, not with Lead Generation. With lower ad spends it can be hard to generate results ideal results as Facebook has a harder time learning.

FACEBOOK ADS FOR MORTGAGE BROKERS COURSE

Learn to run Facebook Ads the right way so you can feel confident you are running your campaigns correctly and maximizing your leads.

Recently updated.

Learn more here - Facebook Ads Course For Mortgage Brokers

The next step is to estimate your lead to customer conversion rate. How many of these will convert to actual customers?

This is the point where marketing leaves off, and your sales processes and sales skills come into play.

How quickly did you respond to the initial lead? Do you have a program that meets their needs?

For those who are not ready to sign up, do you have a lead nurturing campaign for those leads that adds value and builds rapport ongoing?

All these factors play a role in the percentage of prospects you convert from a lead to an actual customer. And the longer you run ads; the more your sales funnel will fill full of potential prospects.

6

Customer-Focused Landing Pages

Squeeze even more value from your ad spend

Landing pages, in this case, are not as critical since we are using Lead Ads that capture the customer's information right within Facebook, but custom landing pages do help squeeze even more value from your ad spend.

When someone fills out the Lead Ad form and submits it, you have the lead. From there, you can include a link to a landing page after the prospect submits the form where the prospect can click through to a landing page on your website.

Your Landing Page would have content that speaks to that customer persona needs, and includes trust marks, testimonials, background on you and specifically how you will help them – all elements that reduce friction in the sales process and build rapport and excitement for what you have to offer them.

On your landing page, you could then include a link to your online calendar where a potential customer can book a meeting right away, or you can add a click-to-call button to get you on the phone right away.

Just as we did with the ad content with the images and copy, align landing pages use similar images and copy here, too. Always use images and copy that speak to the customer that she can relate to.

7

Lead Nurturing

Important for longer sales cycle leads

Not all the leads you capture on Facebook are ready for a mortgage at the same time. Maybe they are not sure what neighborhood they want to buy in, they are still saving for the deposit or other factors. (read this related post on Lifecycle Marketing and Marketing Automation for Mortgage Brokers)

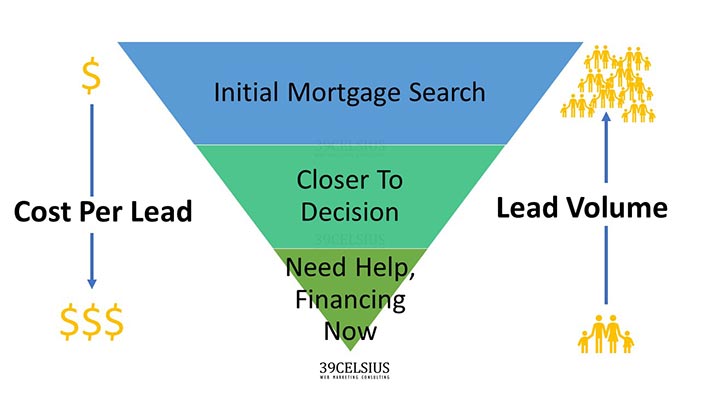

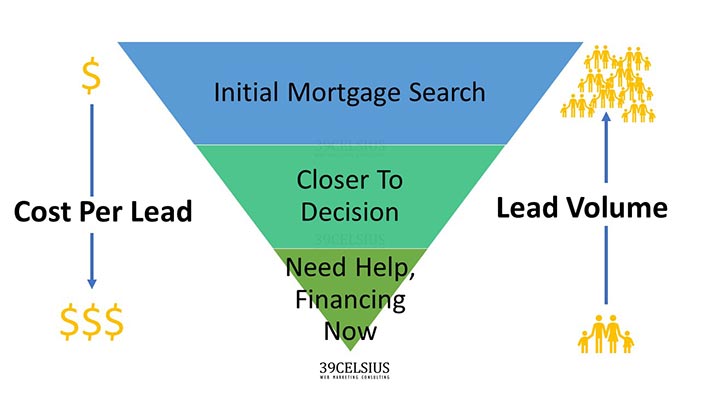

The below infographic illustrates this point.

The volume of leads is the largest when the customer is beginning her search for mortgage products. Customers at this stage - the top of the funnel - are the least expensive since they are furthest away from needing you right now.

As you move through the customer journey over time, the mortgage customer gets closer to needing help right now and economic value increases - these customers are the fewest and most expensive since everyone wants these leads and is bidding for them.

How can I focus more on the bottom of the funnel where the prospects are that need my services now?

There are a number of changes you can make to emphasize people that are closer to making a decision now.

- Add pre-screening questions in your Lead Ad form before they fill it out

- Add pre-screening questions to your landing page

- Adjust a setting in Lead Ads that tells Facebook to go after "higher intent" leads

Keep in mind, making these edits will raise your cost per lead.

Mortgage Customer Sales Funnel

Mortgage Customer Sales Funnel

But just because a customer in the beginning stages of a search at the top of the funnel does not mean you should avoid these leads.

How Do I Convert Leads That Are Higher Funnel, Longer Sales Cycle?

Those most successful at marketing mortgage leads will put these prospects into an email lead nurturing sequence that drips valuable, helpful content over time, thus squeezing more value out of the ad spend.

For leads that are not ready right now, do not pitch constantly - people hate that.

Nobody wants to hear you talk about how great you are or how great your company is.

Customers want solutions to their pain points, and answers to their questions so deliver that to them.

Be a problem solver and help them through this journey.

Always have a call-to-action in your emails, of course, but make it a priority to deliver value and be helpful first and you will be far more successful with much happier customers.

Where do I start with lead nurturing emails?

So think about the most common questions and pain points these longer sales cycle customers have and include solutions for them and add value in each email that is dripped out over time.

Lead nurturing campaigns require some work upfront to get them going – creating the content that you're delivering, pacing the email delivery out over time, are you including any behavioral signals for when the emails are triggered? Will you be using a more robust marketing automation platform? But once these email campaigns are going, the ongoing maintenance is less.

Read our related post here on the benefits of Lifecycle Marketing and Marketing Automation and how it can significantly scale your lead generation efforts.

In Summary:

Facebook ads are a powerful way to fill your sales funnel and reach potential customers on an ongoing basis that need your services.

If you're a mortgage broker or loan originator looking to generate leads from Facebook ads, these are the 6 most important factors to consider.

- 1Decide which customers you want to target

- 2What geographic area are you targeting?

- 3What is your psychographic targeting?

- 4Decide on a budget that will meet your goals

- 5Use custom landing pages

- 6Set up lead nurturing sequences to squeeze more value out of your ad spend

PRo Tip - Webinars

If you feel comfortable on video, you can also use Facebook ads to drive webinar signups. Brokers have used this strategy to successfully close more deals. The webinar process can be automated to remove much of the burden off of you. In addition, as part of the email lead nurturing I mentioned above, you can email your list of leads about an upcoming webinar to keep them engaged and close more sales.

Done For You Service

Reach out to us today to find out about our Facebook ads Done For You Service. We can setup and manage all aspects of a Facebook ad campaign for you.